Explore Trick Developments in the World of copyright News

The landscape of copyright is undertaking significant change, driven by a convergence of governing innovations, technological advancements, and moving market patterns. Trick governing bodies, such as the SEC and CFTC, are refining their approaches to digital assets, while developments like Layer 2 options improve purchase performance. Simultaneously, a surge in institutional investment underscores a growing approval of cryptocurrencies. Yet, as safety and security issues intensify, the ramifications for the future of digital currencies remain uncertain. What might these advancements imply for both investors and customers in the coming months?

Governing Modifications Impacting copyright

The recent wave of regulatory adjustments is dramatically reshaping the landscape of the copyright market. Governments globally are progressively recognizing the demand for extensive frameworks to attend to the chances and risks presented by digital properties. In the United States, governing bodies such as the Securities and Exchange Payment (SEC) and the Product Futures Trading Payment (CFTC) are working to make clear the classifications of cryptocurrencies, specifically comparing products and protections. This regulatory quality is important for cultivating development while guarding investors.

These governing developments are motivating copyright exchanges and banks to adjust their conformity approaches, ensuring they satisfy brand-new standards. Because of this, boosted regulatory oversight may bring about enhanced institutional fostering of cryptocurrencies, inevitably adding to the market's maturation. The developing regulative landscape additionally poses challenges, as stakeholders navigate the complexities of compliance in a quickly transforming setting.

Significant Blockchain Innovations

Another significant technology is the development of Decentralized Financing (DeFi) methods, which utilize wise agreements to supply financial services without standard middlemans. This change not only democratizes access to monetary items yet also fosters higher openness and protection.

Interoperability methods are additionally gaining grip, permitting different blockchain networks to interact and share data perfectly (Investment). This is critical for creating a more cohesive community, where possessions and details can move easily throughout varied systems

Furthermore, developments in Non-Fungible Tokens (NFTs) have expanded past electronic art into areas such as gaming and realty, showcasing the convenience of blockchain applications. These technologies jointly suggest a dynamic landscape, paving the means for wider adoption and integration of blockchain modern technology throughout markets.

Market Trends to See

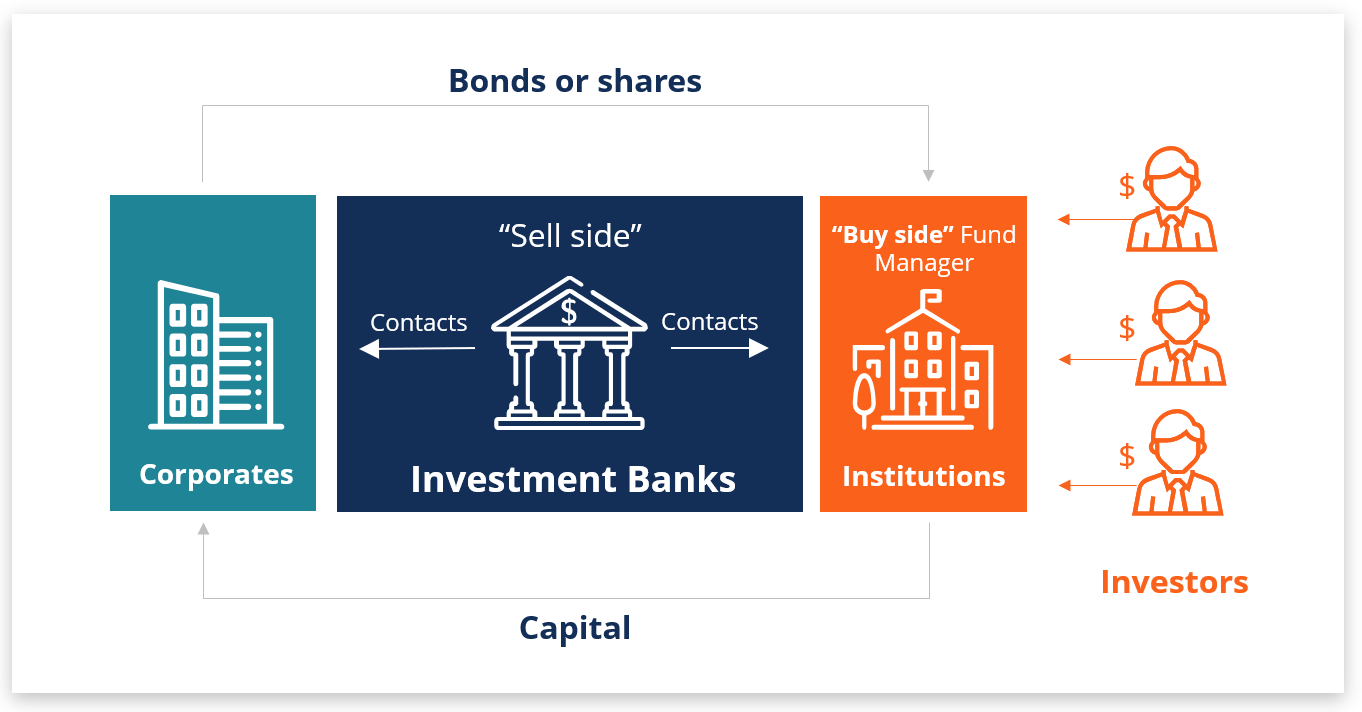

As the landscape of blockchain modern technology progresses with significant innovations, focus turns to the market fads that are shaping the future of the copyright space. Among the most remarkable patterns is the enhancing institutional interest in cryptocurrencies. Significant banks and companies are diversifying their profiles by purchasing electronic assets, signifying a shift towards mainstream acceptance.

In addition, the increase of decentralized finance (DeFi) remains to gain grip, providing customers with alternative economic services without typical intermediaries. This fad is accompanied by a raising number of decentralized applications (copyright) that boost user interaction and drive fostering.

One more market fad is the concentrate on regulative clarity. Governments around the globe are developing structures to control copyright activities, which can dramatically impact market dynamics. The advancing regulatory landscape will likely influence capitalist sentiment and promote a much more lasting market environment.

Safety and Fraudulence Developments

Navigating the complex landscape of copyright necessitates a heightened focus on safety and security and fraud developments. Additionally, decentralized finance (DeFi) platforms have arised as eye-catching targets, with numerous link top-level hacks resulting in substantial economic losses.

Regulative bodies are reacting to these difficulties by carrying out stricter guidelines focused on boosting protection methods. The Financial Action Job Force (FATF) has presented actions requiring copyright exchanges to take on Know Your Consumer (KYC) processes, aiming to minimize dangers associated with cash laundering and terrorism funding.

As the copyright market evolves, continuous vigilance and durable protection actions will certainly published here be extremely important in combating fraudulence and making certain the honesty of electronic possessions (Investment). Services and customers alike must remain proactive and informed in securing their interests

Future of Digital Currencies

The future of digital currencies holds tremendous possibility, guaranteeing to reshape global financial systems and enhance financial inclusivity. As governments and reserve banks discover Central Bank Digital Currencies (CBDCs), the landscape of conventional finance can progress considerably. CBDCs aim to give safe, efficient, and easily accessible settlement services, potentially lowering deal costs and boosting financial openness.

Beyond CBDCs, the increase of decentralized money (DeFi) systems indicates a change toward self-sovereign monetary systems. These platforms make it possible for individuals to participate in financing, loaning, and trading without intermediaries, hence democratizing accessibility to financial solutions. Additionally, the assimilation of blockchain innovation throughout various fields is poised to enhance operations, improve security, and foster depend on.

However, the journey towards prevalent adoption is not without difficulties. Regulatory frameworks have to adapt to deal with worries around safety, market, and personal privacy security. Cooperation in between regulatory authorities, industry players, and technology suppliers will certainly be important to produce a balanced environment that cultivates technology while making certain consumer protection.

Conclusion

Finally, the landscape of copyright is undergoing significant change driven by regulative modifications, technological developments, and developing market dynamics. The establishment of extensive frameworks by regulatory bodies, paired with innovations in blockchain modern technology and raising institutional passion, emphasizes a growth within the industry. Additionally, heightened awareness of protection problems highlights the value of securing digital properties. These advancements collectively lead the way for more comprehensive fostering and combination of digital read this post here money right into the worldwide financial system.

The landscape of copyright is going through significant improvement, driven by a confluence of governing developments, technical advancements, and changing market patterns.The current wave of regulatory adjustments is considerably improving the landscape of the copyright market.These regulatory advancements are prompting copyright exchanges and monetary establishments to adapt their conformity strategies, ensuring they fulfill new requirements. As an outcome, enhanced regulative oversight might lead to increased institutional adoption of cryptocurrencies, eventually adding to the market's maturation.In final thought, the landscape of copyright is undertaking significant improvement driven by governing changes, technological improvements, and advancing market dynamics.

Comments on “Building Wealth: The Long-Term Advantages of Consistent Investment Habits”